Avoid interests and penalties with WeP MANAGED GST FILING SERVICES, A complete solution to your GST return filing worries.

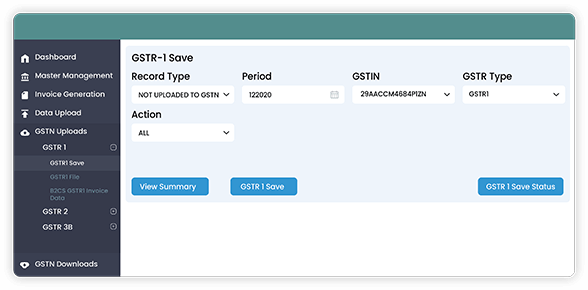

Provide GST compliant data to our return filing professionals and they manage the entire filing process with their expertise knowledge till submission of the return. Entire process is driven through the utility of Wep ASP software, loaded with varied user-friendly features.

Monthly GST returns

- Refines and aligns data in conformity with the GST Act and rules

- Takes care of latest updated changes

- Performs multiple data validations to ensure error free return

- End to end customer co-ordination

- Filing of return within due dates

- Easy and better compliance experience

- Round the clock support to customers on filing days

- Prefill of GSTR-3B from GSTR-1 and GSTR-2 (Purchase register) e

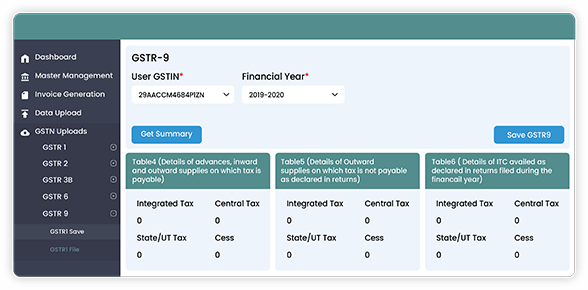

Annual return-GSTR-9

- An expert team to gather and fill required return information

- Verification of data accuracy with various filed returns

- Simplified filing with an excel template

- Auto drafted GSTR-9 report from GST portal

- Other affiliated customized services on request

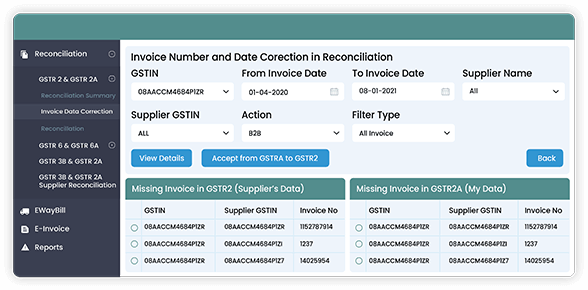

Claim optimum ITC

Minimize tax disputes and litigations with our reconciliation services as it helps in determination of legitimate claim of Input Tax Credit

- Reconciliation of GSTR-2 Vs GSTR-2A and of GSTR-6 Vs GSTR-6A

- Simultaneous reconciliation of amendment data

- Reconciliation by experts, based on agreed upon procedures

- Automatic matching of invoices

- Triggering notifications to Vendors on mismatches

- Gathering vendor responses with two-way access mechanism

- Exclusive reconciliation settings to meet customer reporting requirements

- Multiple summary and detailed reports

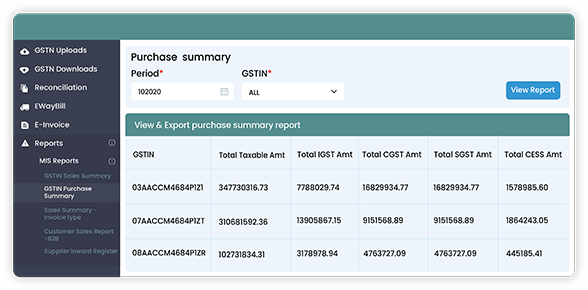

Reports and Downloads

- Periodical and intermittent provision of GST return downloads

- Hassle free download of voluminous returns data for multiple GSTIN’s and periods

- Reports on validity of vendor GSTIN’s

- Reports to track GSTR-1/3B filing status of vendors

- Handy log files with all inward/outward activities registered

- Multiple MIS reports like:

- Sales summary

- Purchase summary

- Supplier wise GSTR-2A report

- Supplier wise reconciliation report

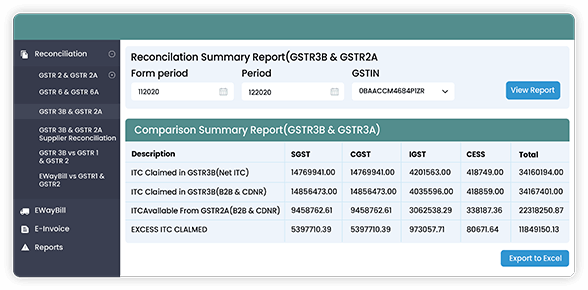

Compare, analyse, and decide

Many summarized, comparison reports which are available highlights variances, aids in management reporting, better decision making and timely actions:

- GSTR-1 Vs GSTR-3B

- GSTR-2 Vs GSTR-3B

- GSTR-2A Vs GSTR-3B

- GSTR-1 Vs e-way bill

Other services

- Assistance in handling customer/vendor queries on GST returns

- Generation of inward/outward/RCM invoices with reasonable customizations

- Provision of other customized reports on request

Data privacy

- Stringent data security policies as GST return data are insider information.

- Maintains data integrity at all stages of processing.

- Our GST infrastructure has been audited by third party auditor appointed by GSTIN

- 100% transparency with complete access to client

- Implementation of Data back-up plans and disaster recovery plans