Experience the Fastest GST Filing Software with

6000

Invoices Matching at Once

WeP has 20 Years of Experienced in Digital Transformation Solutions.We

are

the Licensed GST Suvidha Provider(GSP).

Claim 100% Input Tax

Credit

256 Bit

Security (Best in Industry)

Support & 99.99% Uptime Recorded

Connect with any ERP with Ease

Why Choose WeP

GST Software ?

-

-

-

Experienced

Technical Support

-

-

-

-

Role & Location Based Access

Control for User Management

-

-

-

-

Compatible with all ERP &

Accounting Software

-

-

-

-

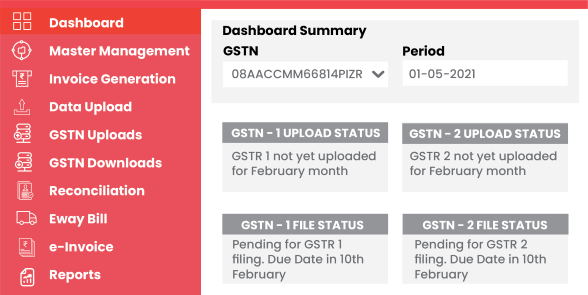

User Friendly Dashboard and

Downloadable Reports

-

-

-

-

99.99% Uptime and 100+

Data Validation Parameters

-

-

-

-

Invoice Generation

Module

-

-

-

-

Single Login for GST Returns,

Reconcillations, e-Invoice &

E-Way Bill

-

-

-

-

Supplier and Customer

Master Data Management

-

GST return filing software

- Takes care of monthly, quarterly, and annual GST compliances

- GSTR-1, GSTR-2(Purchase register), GSTR-3B, GSTR-6, GSTR-8, and GSTR-9

- Handy and coherent navigation of options

- Template repository

- User friendly templates with highly explanatory attributes annexure

- Validate, upload, and save- Just 3 steps to file any return

- Comprehensible error description for quick rectification

- Fast uprun from GST

- Supports submission and filing of return with DSC

- Supports bulk uploads and downloads in shortest time

- Easy support seeking mechanism and dedicated support resource for speedy resolution of issues and grievances

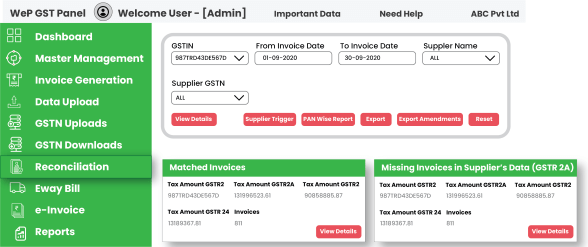

GST reconciliation software- Reconciliation between GSTR-2 and 2A and GSTR-6 and 6A

- Detailed dashboard enhances visibility of ITC discrepancies at both summary and supplier level

- Action oriented, segmented information like matched documents, missing documents, and mismatched documents

- Automatic system matching fastens reconciliation process

- Multiple options to resolve apparent mismatches due to inconsistent document details

- Hold invoices option, in line with GST provision, to defer ITC claims

- No separate reconciliation for amendments as same is incorporated with the original return data

- Enables precise and accurate claim ITC

- Automatic mail triggering mechanism notifies discrepancies to vendors, captures and forwards replies from vendors

- Separate and independent setting to configure features

- Various useful reports to enable better and timely decision making

Data privacy

- Information system audit and assurances

- Data back up plans, Business continuity plans and disaster recovery plans

- Stringent employee work environment policies to avoid data misuse

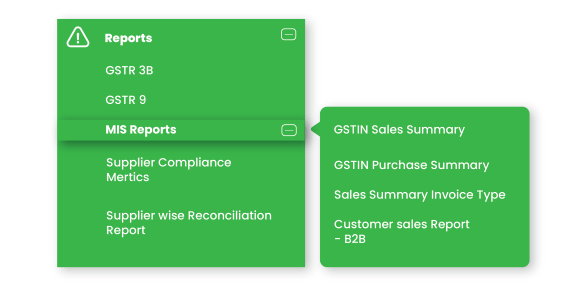

Reports

- MIS reports

- Log files with track of every minute information uploaded and downloaded

- Various in-built comparison reports to analyse and take decision

- Swift and Bulk download of reports from GST pertaining to multiple GSTIN’s and periods at once

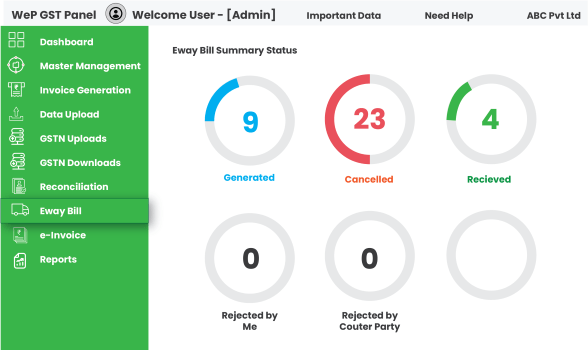

E-Way bill

- Exclusive dashboard with glimpse of useful compliance statistics

- Quick and bulk generation of e-way bill using templates

- Easy up dation and cancellation of e-way bills

- View, print and download e-way bill option

- Various useful reports on e-way bills generated

- Initiate action on e-way bill generated by others like rejection

- Customizable features to trigger e-mails on successful generation of e-way bills

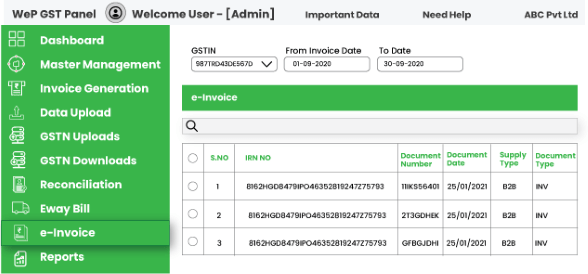

e-Invoicing

- Informative dashboard providing useful insights

- Supports both generation of e-Invoice through Integration with ERP and directly in WEP ASP using templates

- Facilitates quick generation of Invoice Reference Number

- View/print and download e-Invoice with entity’s logo

- Generate and cancel e-Invoice associated e-way bills

- Reports on e-Invoice data with varied status

- Handy support system